Time-Based Invoices: A time-based Invoice is used to charge your clients for a tracked number of hours that you spent working on their project.Prepayment Invoices: This type of invoice is used to collect a deposit or down payment before you do the work – or before the entire payment is due.Recurring Invoices: A recurring Invoice is used to collect ongoing services.It will include a description of the service, the cost, accepted payment methods and due date Standard Invoices: A standard invoice is straightforward and is used to bill for your services whenever a service is rendered.Fortunately, there are many different formats to choose from – and all of them are customizable when you do your business invoicing through FreshBooks. The invoice type that you need will depend on the kinds of services you offer, how you accept payments, what your billing schedule is and how you prefer to communicate with your clients. That’s why it’s worth checking out a variety of invoice formats below you decide which one is right for you. Your business is unique – so your invoices should be, too. Simply download your template of choice, customize and send.īrowse the sample invoice formats below to find the right fit for your business invoicing.

You can format your invoice online with FreshBooks or in Word, Excel or another program that you are familiar with. Having the right format also makes your invoicing more organized and streamlined. Not only will this information help your clients pay you, but it will come in handy when it comes to organizing your business finances.

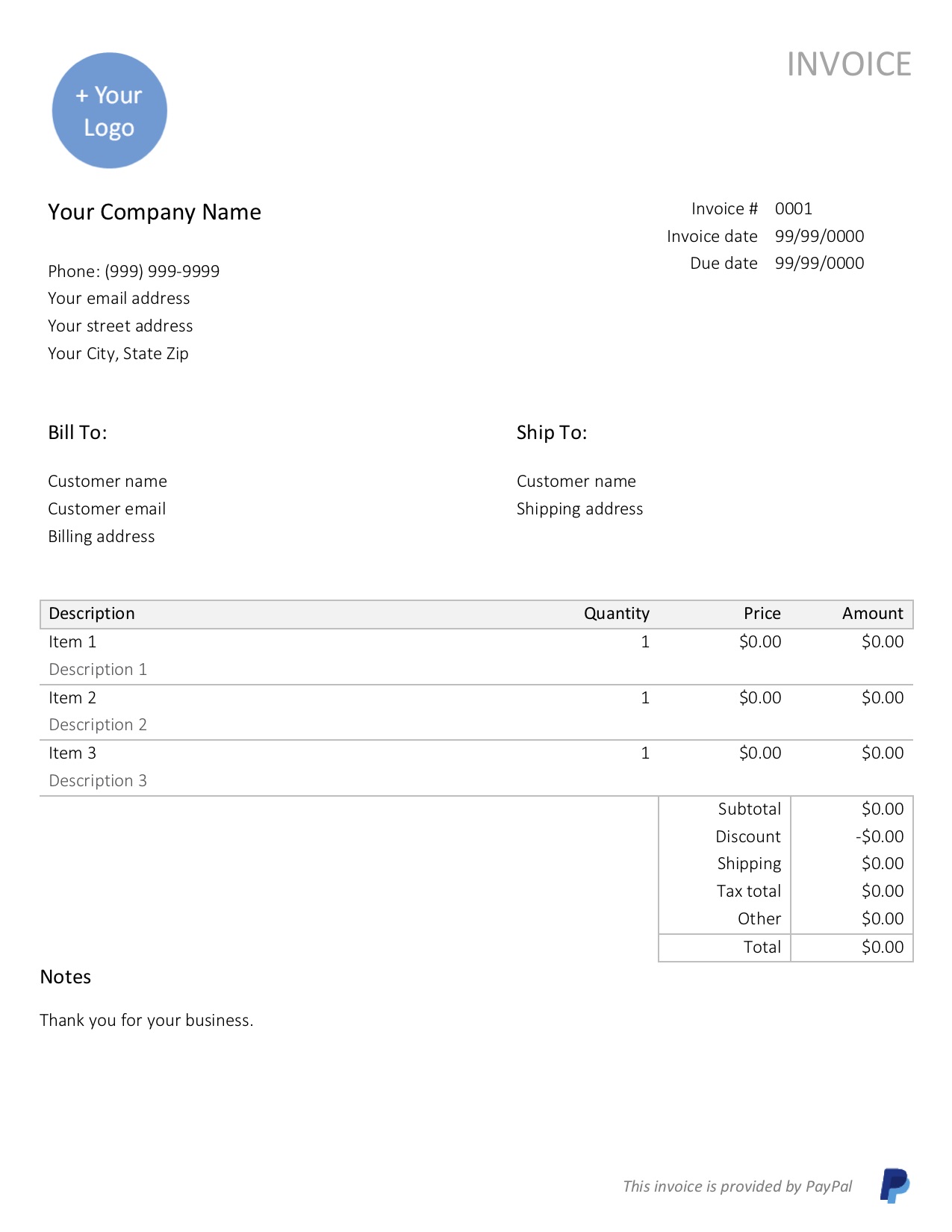

To ensure that you get paid correctly and on time, you should format your invoice with all of the necessary details.

However, you first need to start by formatting your invoice and customizing it to suit your needs. With the right invoice format, both charging for your services and getting paid by your clients are made simple. Whether you are a small business owner, a freelancer or anything else in between, billing for your services is an important component of your business’ success.

0 kommentar(er)

0 kommentar(er)